Boston Scientific Corporation, a prominent medical device manufacturer, has manufactured transvaginal surgical mesh devices since the late 1990s, developing products designed to treat two common women’s health conditions affecting millions of Americans.

These synthetic mesh implants promised minimally invasive surgical solutions for pelvic organ prolapse (POP) and stress urinary incontinence (SUI), conditions that can impact quality of life.

The devices were marketed as offering durable support through permanent implantation, revolutionizing traditional surgical approaches that required more invasive procedures with longer recovery times.

Types of Boston Scientific Mesh Products Subject to Legal Action

Boston Scientific developed an extensive portfolio of surgical mesh products that have become the subject of thousands of lawsuits nationwide.

The specific products involved in litigation include, but are not limited to:

- Uphold LITE Vaginal Support System – A pelvic mesh device designed for apical and anterior vaginal wall prolapse repair, utilizing lightweight polypropylene mesh with adjustable arms for customized support

- Xenform Soft Tissue Repair System – A biologic graft product intended for POP repair that was ordered off the market by the FDA in April 2019

- Obtryx Transobturator Mid-Urethral Sling System – A polypropylene mesh sling for SUI treatment that remains commercially available with both halo and curved needle configurations

- Advantage Transvaginal Mid-Urethral Sling System – First approved in 1996, representing one of Boston Scientific’s earliest entries into the transvaginal mesh market

- Solyx Single-Incision Sling System – A newer generation medical device featuring snap-fit technology for micro-adjustability during placement

- Lynx and Prefyx Systems – Additional mid-urethral sling products designed for varying surgical approaches and patient anatomies

The distinction between POP and SUI devices proved important when the FDA ordered the removal of all transvaginal POP mesh products from the market in 2019, determining that mesh manufacturers failed to demonstrate reasonable assurance of safety and effectiveness.

While products like the Uphold LITE and Xenform were immediately discontinued, certain SUI slings including updated versions of the Obtryx, Solyx, and Advantage systems remain commercially available with enhanced warning labels.

This regulatory action validated concerns that thousands of women had raised through legal action, though many continue to suffer irreversible complications caused by devices implanted before the market removal.

If you or a loved one experienced complications from a Boston Scientific mesh implant including chronic pain, mesh erosion, or required revision surgery, you may be eligible to seek compensation.

Contact TruLaw using the chat on this page to receive an instant case evaluation and determine whether you qualify to join others in filing a Boston Scientific vaginal mesh lawsuit today.

The Polypropylene Material Controversy

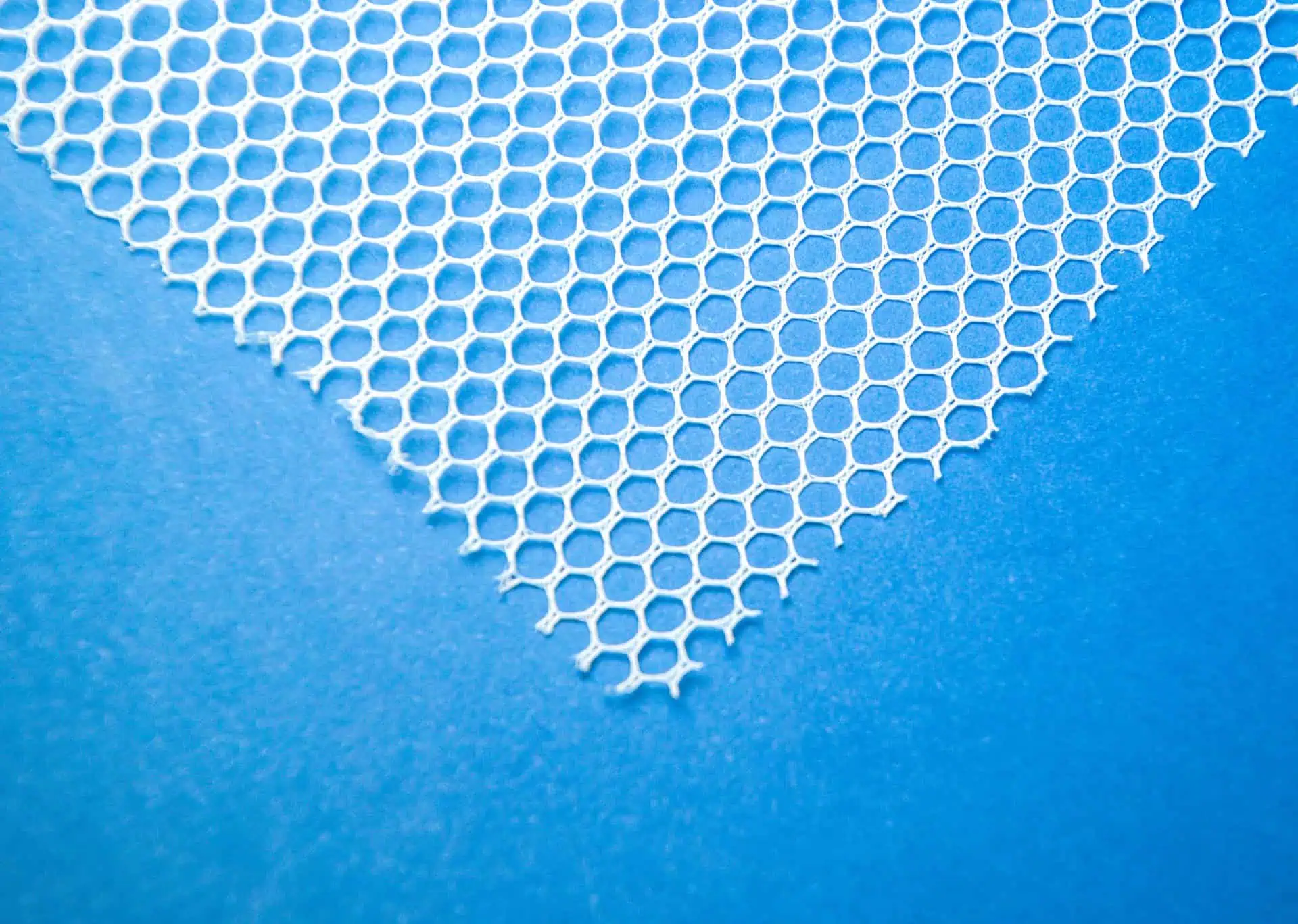

The foundation of Boston Scientific’s mesh products centers on polypropylene, a synthetic plastic material that became the subject of intense scrutiny regarding its suitability for permanent human implantation.

Key concerns about the polypropylene used in mesh manufacturing include:

- Chevron Phillips’ 2004 warning – The manufacturer of Marlex polypropylene resin issued explicit guidance stating the material should not be used for permanent implantation in the human body

- Material sourcing changes – Evidence suggests Boston Scientific sourced polypropylene from Chinese suppliers after the Marlex warning, potentially using materials without proper safety documentation

- Oxidative degradation – Scientific studies demonstrate polypropylene undergoes oxidative breakdown when exposed to human tissue

- Chronic inflammatory response – The material triggers ongoing foreign body reactions, leading to excessive scar tissue formation and tissue integration problems

- Mesh shrinkage – Research shows polypropylene mesh can contract by up to 50% in width after implantation, creating tension and pain

Internal documents revealed during litigation suggest Boston Scientific was aware of potential material concerns but continued using polypropylene in their mesh products.

The company conducted limited testing, primarily involving rabbit studies lasting only 12 weeks, failing to assess long-term effects of permanent implantation in humans.

This abbreviated testing protocol became a central allegation in pelvic mesh lawsuit filings, with plaintiffs arguing that proper biocompatibility studies would have revealed the unsuitability of polypropylene for transvaginal placement.

The material’s tendency to degrade, combined with the bacterial-rich environment of the vagina, created conditions for chronic complications that often proved irreversible even with removal surgery.

Timeline of Boston Scientific’s Market Involvement

Boston Scientific’s journey in the transvaginal mesh market spans over two decades, marked by rapid expansion, regulatory challenges, and eventual market restrictions.

The company’s involvement in mesh manufacturing followed this timeline:

- 1996 – FDA approval of Boston Scientific’s first transvaginal mesh device, the Advantage Mid-Urethral Sling System, using the 510(k) clearance process

- Early 2000s – Aggressive market expansion with multiple product launches targeting both POP and SUI indications

- 2004 – Introduction of the Pinnacle Pelvic Floor Repair Kit series, marketed as offering superior outcomes to traditional native tissue repair

- 2007-2010 – Launch of next-generation products including Obtryx and Solyx systems, despite mounting adverse event reports to the FDA

- 2011 – Class II recall of Pinnacle kits due to needle detachment concerns, though products remained on market with modifications

- 2019 – FDA-ordered removal of Uphold LITE and Xenform products from market, ending Boston Scientific’s POP mesh sales

- 2021 – $189 million multistate transvaginal mesh settlement resolving allegations of deceptive marketing practices

Financial reports indicate pelvic mesh products represented approximately one percent of Boston Scientific’s annual revenue, though the company maintained these devices served important medical needs despite safety concerns.

The corporation, generating over $14 billion in annual sales by 2023, positioned itself as a leader in women’s health while simultaneously facing approximately 54,000 mesh-related claims.

Boston Scientific’s current market position reflects a strategic shift away from transvaginal POP repair while maintaining select SUI products, acknowledging through enhanced warnings the permanent nature of mesh implantation and difficulty of removal that plaintiffs had long alleged in their lawsuits.