Social Security Disability Insurance: The Ultimate Guide

- Last Updated: July 9th, 2024

Attorney Jessie Paluch, founder of TruLaw, has over 25 years of experience as a personal injury and mass tort attorney, and previously worked as an international tax attorney at Deloitte. Jessie collaborates with attorneys nationwide — enabling her to share reliable, up-to-date legal information with our readers.

Legally Reviewed

This article has been written and reviewed for legal accuracy and clarity by the team of writers and legal experts at TruLaw and is as accurate as possible. This content should not be taken as legal advice from an attorney. If you would like to learn more about our owner and experienced injury lawyer, Jessie Paluch, you can do so here.

Fact-Checked

TruLaw does everything possible to make sure the information in this article is up to date and accurate. If you need specific legal advice about your case, contact us by using the chat on the bottom of this page. This article should not be taken as advice from an attorney.

Key takeaways:

- SSDI is a tax-funded federal program providing financial aid to disabled individuals unable to work.

- SSDI eligibility requires meeting SSA's disability definition and having sufficient recent work history.

- SSDI application is a complex, long process requiring detailed medical documentation and possibly multiple appeals.

Introduction to Understanding Social Security Disability Insurance

Our Social Security Disability Insurance guide is designed to provide a comprehensive understanding of Social Security Disability, including eligibility criteria, application procedures, common steps applicants must take, and much more.

The Social Security Administration (SSA) provides a crucial service for people with disabilities.

They guide applicants through necessary steps when filing their claim and offer TTY services for applicants who have hearing or speech disabilities.

The Social Security Disability program, administered by the SSA through your local office, offers financial aid to persons with disabilities, enabling them to live a life of dignity.

However, errors can sometimes impact the benefits applicants are entitled to receive.

To be eligible for Social Security benefits, individuals must meet specific criteria to obtain benefits.

The Social Security Administration (SSA) has set forth guidelines for determining eligibility, taking into account various factors related to disabilities.

This ensures that those who genuinely need assistance receive the service promptly and have the right to appeal if necessary.

The Social Security Disability Administration offers different types of benefits depending on an individual’s disability status, catering to a variety of needs and situations.

The program offers different types of financial aid, such as Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI), aiming to enhance the financial support provided to individuals.

The Importance of Online Disability Application and Appeal

The significance of the online disability application and appeal process is immense.

This process provides a vital financial safeguard for individuals dealing with disabilities, enabling them to meet necessary expenses and obtain required healthcare services.

In the absence of such support, many individuals would encounter significant difficulties in their everyday lives.

It is important to be prepared with your social security number when initiating the application process.

The following sections will provide a detailed explanation of this crucial program.

Understanding the online disability application process is essential.

It is important to equip yourself with the necessary information to effectively navigate this system, ensuring that all individuals receive the support they are entitled to.

Table of Contents

SSDI vs. SSI: What's the Difference?

SSDI: Disability Benefits for Workers

Social Security Disability Insurance, also known as SSDI, is a federal program that provides financial support to workers who have become disabled and are unable to continue working.

The purpose of this program is to assist those who suffer from a disability that is expected to last for a prolonged period.

Eligibility for SSDI is determined by the amount of work credits the applicant has accumulated throughout their employment history.

This is in contrast to other government assistance programs, such as Supplemental Security Income (SSI), which are based on the applicant’s income or a combination of limited income and resources.

SSDI, on the other hand, is primarily concerned with the applicant’s employment history and earnings record.

The benefits that an individual receives from SSDI are calculated based on their average lifetime earnings.

The fundamental principle of SSDI is straightforward:

If a person has been employed and has paid into the Social Security system via payroll taxes, they are eligible to receive benefits if they become disabled prior to reaching the age of retirement.

In essence, SSDI serves as a protective mechanism for those who have been active members of the workforce but are now unable to work due to their disabilities.

Eligibility Based on Work History

In order to be eligible for SSDI benefits, certain work history-related prerequisites must be fulfilled by individuals:

- Work Credits: Candidates accumulate work credits on the basis of their yearly earnings and contribution towards Social Security taxes. The quantity of credits required is contingent on the age at which the disability transpired.

- Duration of Work: As a general rule, candidates are required to have been employed for a specified number of years prior to becoming disabled.

- Recent Work: The SSA (Social Security Administration) also takes into account recent work while assessing eligibility.

SSI: Assistance for Low-Income Individuals with Disabilities

SSI, or Supplemental Security Income, is a needs-based program aimed at providing financial assistance to low-income individuals with disabilities who may not qualify for SSDI benefits due to insufficient work credits or lack of substantial earnings.

Unlike SSDI, SSI eligibility is primarily determined by an individual’s income and resources.

The program ensures that those with limited financial means are still able to access the support they need.

SSI benefits are intended to cover basic necessities such as food, shelter, and clothing.

Eligibility Based on Income and Resources

To qualify for SSI benefits, applicants must meet specific criteria related to their income and resources:

- Income Limits: The SSA considers both earned and unearned income when determining eligibility for SSI. Earned income includes wages from work, while unearned income encompasses sources such as pensions or Social Security retirement benefits.

- Resource Limits: Applicants must have limited resources, including cash, bank accounts, property (other than a primary residence), and certain personal belongings.

SSI is designed to provide assistance to individuals who may not have had the opportunity or ability to work due to their disabilities.

It ensures that even those with minimal work history can receive the necessary support to maintain a basic standard of living.

Types of Benefits under Social Security Disability

Disability Insurance Benefits (DIB)

The Social Security Administration (SSA) provides Disability Insurance Benefits (DIB) to workers who are disabled.

This type of support is vital as it ensures that individuals who cannot work due to a disability have a regular income to meet their daily expenses.

The DIB program provides financial stability and reassurance during difficult periods.

To be eligible for DIB, an individual must have accumulated enough credits through their work history and have made contributions to the Social Security system.

The benefits that an individual receives are determined by their average lifetime earnings prior to becoming disabled.

The SSA uses a complicated formula to compute this amount, considering factors such as the individual’s age, income history, and years of employment.

DIB can greatly reduce the financial strain caused by a disability.

It enables individuals to concentrate on their health and well-being without the stress of figuring out how to cover their expenses.

These benefits serve as a critical support system for disabled workers, giving them the chance to maintain their independence and standard of living.

Disabled Widow(er)’s Benefits

The Disabled Widow(er)’s Benefits program is established to provide financial support to surviving spouses who have become disabled subsequent to their partner’s demise.

The death of a spouse is a distressing event, and the onset of a disability can exacerbate the emotional and financial strain.

The purpose of the Disabled Widow(er)’s Benefits program is to alleviate some of these pressures.

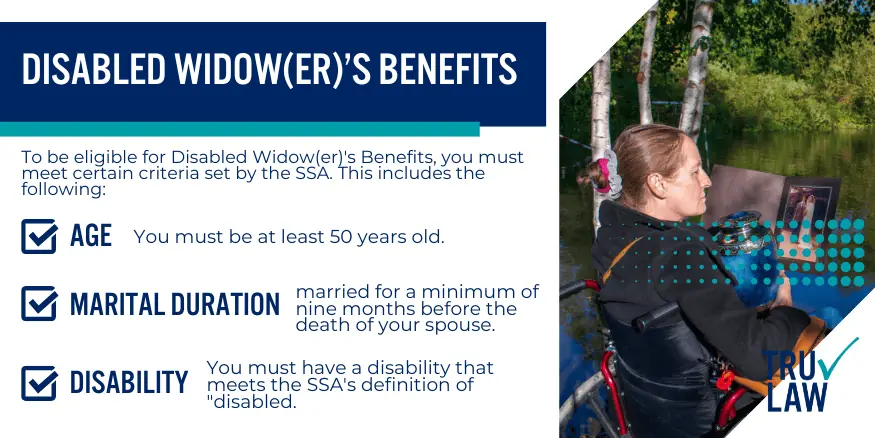

Eligibility for Disabled Widow(er)’s Benefits is determined by the Social Security Administration (SSA) based on specific criteria.

The requirements include:

- Being a minimum of 50 years old;

- Having been in a marital relationship for at least nine (9) months prior to the spouse’s death; and

- Having a disability that aligns with the SSA’s definition of “disabled.”

Disabled Widow(er)’s Benefits provide a monthly income that is comparable to the Disability Insurance Benefits.

This financial aid to disabled surviving spouses offers a level of financial stability during a challenging period in their lives.

The benefits are designed to allow these individuals to concentrate on recovery and restructuring their lives, without the additional burden of financial instability.

Childhood Disability Benefits

The Childhood Disability Benefits program is a crucial service provided by the Social Security Administration (SSA) to eligible families with disabled children.

This program offers financial aid to alleviate the expenses related to the care of a disabled child.

The primary objective of these benefits is to guarantee that disabled children have access to necessary medical treatments, therapeutic interventions, and other essential resources for their overall well-being.

In order to be eligible for Childhood Disability Benefits, the child must have a physical or mental condition that significantly restricts their activities.

This condition must be expected to last for a minimum of one (1) year or to cause the child’s death.

The income and resources of the family are also evaluated during the application process for these benefits.

These benefits are instrumental in ensuring that children with disabilities receive the necessary care.

They allow families to afford the required medical treatments, therapy sessions, educational support, and other services essential for their child’s development.

Childhood Disability Benefits help to alleviate the financial burden on families, thus contributing to an improved quality of life for disabled children.

Disabled Adult Child Benefits

The Disabled Adult Child Benefits program is a provision of the Social Security Administration (SSA) designed to aid adults who became disabled before they reached the age of majority.

This program acknowledges the ongoing difficulties that certain individuals may experience due to disabilities that originated in their childhood, and the need for persistent support into their adult lives.

In order to be considered eligible for the Disabled Adult Child Benefits, an individual must satisfy certain criteria:

- The individual must be aged between 18 and 22.

- The disability must have commenced prior to the individual reaching the age of 22.

- One of the individual’s parents must either be a recipient of Social Security retirement or disability benefits, or they must be deceased but have had a sufficient work history under the Social Security system.

The Disabled Adult Child Benefits program provides a monthly income to recipients, comparable to other forms of Social Security disability benefits.

This financial assistance ensures that adults who have been disabled since childhood have the means to lead fulfilling lives in spite of their disabilities.

The benefits aid recipients in covering the costs of daily living, obtaining necessary medical care, and preserving their autonomy.

Eligibility Criteria for Social Security Disability Insurance

To be eligible for Social Security Disability Insurance (SSDI), applicants must meet certain criteria.

These criteria are designed to ensure that the program is accessible only to those who truly require financial support due to a severe medical condition that inhibits their ability to participate in substantial gainful activity.

Here are the specific eligibility requirements:

- Medical Eligibility: The applicant must have a significant medical condition that is expected to last at least one (1) year or result in death. The Social Security Administration (SSA) has a list of conditions that automatically qualify an individual for SSDI.

- Work Credits: SSDI is financed by Social Security taxes. Therefore, only individuals who have contributed to the system through their work are eligible. Eligibility is determined by work credits, which are accumulated by working and paying Social Security taxes. The required number of work credits is dependent on the age of the individual at the time of disability.

- Duration of Disability: The SSA stipulates that an individual must be incapable of working for a minimum of twelve (12) months due to their disability. However, the application process can commence before the individual has been unable to work for twelve (12) months, provided their condition is expected to last for at least that duration.

Fulfilling these requirements does not automatically guarantee SSDI benefits, as the final decision is also contingent on the specifics of each individual case.

It is often beneficial for applicants to seek advice from a knowledgeable attorney or advocate when applying for SSDI.

This can ensure that all necessary documentation is submitted accurately and that the application process is conducted efficiently.

Severe Medical Condition and Duration

One of the primary factors in determining eligibility for SSDI is having a severe medical condition.

This means that the individual’s impairment must significantly limit their ability to perform basic work-related activities.

The condition should be expected to last for at least one (1) year or result in death.

The Social Security Administration (SSA) evaluates each case based on the severity of the medical condition and its impact on an individual’s daily life.

They consider various factors, including the symptoms experienced, treatment received, response to treatment, and any limitations imposed by the condition.

Meeting the SSA’s Definition of Disability

To be eligible for SSDI benefits, applicants must meet the SSA’s definition of disability.

The administration defines disability as being unable to engage in substantial gainful activity (SGA) due to a medically determinable physical or mental impairment that has lasted or is expected to last for at least one year.

The SSA assesses disability claims using a five-step evaluation process.

This involves considering an individual’s ability to perform their previous work, whether they can adjust to other types of work, and if their impairments prevent them from doing any kind of substantial gainful activity.

Earning Sufficient Credits through Prior Work Experience

In addition to meeting the medical criteria, applicants must have earned enough credits through prior work experience.

These credits are accumulated based on income earned while working and paying Social Security benefits and taxes.

The number of credits required depends on an individual’s age when they become disabled.

Generally, younger individuals require fewer credits compared to older individuals who may need more credits to qualify for SSDI benefits.

The SSA uses a system of work credits to determine eligibility.

The number of credits needed will vary, but individuals typically earn one (1) credit for every three (3) months worked and paying Social Security taxes.

Eligibility for Certain Members and Adults

While the primary focus is on individual eligibility, it’s worth noting that certain family members may also be eligible for benefits based on an individual’s disability.

Spouses, children, and even divorced spouses may be entitled to receive auxiliary benefits under specific circumstances.

For older adults, who are not disabled before the age of 22 but have a parent who receives Social Security retirement or disability benefits or is deceased and had enough work credits, they may be eligible for Childhood Disability Benefits (CDB).

This provision allows disabled adult children to receive benefits based on their parent’s work record.

Applying for Social Security Disability: Online vs. Mail

The Convenience and Speed of Online Applications

Many individuals are faced with the decision of whether to apply online or through traditional mail.

While both methods require submitting supporting documents and medical records, applying online offers a range of conveniences that can make the process smoother and more efficient.

One of the primary advantages of applying online is the convenience it offers.

Rather than printing out forms, completing them by hand, and sending them via mail, applicants can simply access the official Social Security Administration (SSA) website from the comfort of their own homes.

This eliminates the need for physical paperwork and reduces the chances of documents getting lost in transit.

Online applications often result in faster processing times compared to mail applications.

The SSA has implemented digital systems that allow for quicker review and evaluation of submitted information.

This means that applicants who choose to apply online may receive a decision on their disability claim sooner than those who opt for mail submission.

Navigating Mail Applications: A Traditional Approach

While online applications provide convenience and speed, some individuals may still prefer the traditional method of applying through mail.

This approach requires printing out application forms provided by the SSA, carefully completing them by hand, and then sending them via postal mail.

Although it may seem less convenient compared to online applications, there are instances where mailing your application might be more suitable.

For example, individuals who do not have reliable internet access or are uncomfortable with technology may find it easier to navigate a paper-based application process.

Moreover, some applicants may feel more confident about physically filling out forms rather than relying on digital platforms.

By having tangible documents in hand during the application process, they may feel a greater sense of control over their submission.

Submitting Supporting Documents and Medical Records

Regardless of whether you choose to apply online or through mail, both methods require submitting supporting documents and medical records to support your disability claim.

These documents play a crucial role in providing evidence of your condition and its impact on your ability to work.

When applying online, the SSA provides a secure portal where applicants can upload their supporting documents electronically.

This eliminates the need for making copies or sending original documents through mail, reducing the risk of loss or damage.

On the other hand, mail applications require applicants to include physical copies of their supporting documents along with their completed forms.

It is essential to ensure that all necessary paperwork is included and properly organized before sending it off.

To streamline the process, individuals applying through mail can create a checklist of required documents and double-check that everything is enclosed in their submission.

This helps minimize any potential delays caused by missing or incomplete information.

In both cases, it is crucial to provide accurate and up-to-date medical records that clearly demonstrate your condition’s severity and its impact on your daily life.

These records should come from healthcare professionals who have treated you for your disabling condition.

Required Documents for Social Security Disability Application

Birth Certificate or Proof of Birth Date

To apply for social security disability benefits, one of the essential documents you will need is your birth certificate or proof of birth date.

This document serves as evidence to confirm your age and is crucial in determining your eligibility for disability benefits.

The Social Security Administration (SSA) requires this information to establish that you meet the age requirements for receiving these benefits.

Your birth certificate is a legal document issued by the government that provides official proof of your birth.

It typically includes details such as your full name, date of birth, place of birth, and the names of your parents.

If you don’t have a copy of your birth certificate, you can obtain one from the vital records office in the state where you were born.

In some cases, individuals may not have access to their original birth certificate due to various circumstances, such as adoption or lost documentation.

If this applies to you, there are alternative documents that can be accepted as proof of birth date.

These documents include, but are not limited to:

- Religious records recorded before the age of five;

- Hospital records;

- Census records; or

- School records created earlier in life.

Proof of U.S. Citizenship or Lawful Alien Status

Another important requirement when applying for social security disability benefits is providing proof of U.S. citizenship or lawful alien status.

This documentation is necessary to establish that you are eligible to receive these benefits based on your immigration status.

If you are a U.S. citizen, acceptable forms of proof include a:

- United States passport;

- Certified copy of your birth certificate issued by an authorized government agency within the United States;

- Consular report of birth abroad if born outside the country but to U.S. citizen parents; or a

- Certificate of Naturalization.

For individuals with lawful alien status who are not U.S. citizens but still eligible for social security disability benefits, appropriate documentation includes an:

- I-551 Permanent Resident Card (commonly known as a green card);

- I-94 Arrival/Departure Record with an endorsement showing temporary evidence of permanent resident status; or an

- Employment authorization document.

It’s important to note that the SSA may require additional documentation depending on your specific circumstances.

If you have any questions about which documents are acceptable or need assistance in obtaining them, it is recommended to contact your local Social Security office for guidance.

Medical Evidence such as Doctor’s Reports, Test Results, and Treatment Details

When applying for social security disability benefits, providing comprehensive medical evidence is crucial in supporting your claim.

Sufficient medical evidence includes, but is not limited to:

- Doctor’s reports;

- Test results; and

- Treatment details that demonstrate the severity of your condition and its impact on your ability to work.

Medical evidence plays a significant role in determining whether you meet the SSA’s definition of disability.

It helps establish the existence of a medically determinable impairment and provides insight into how it affects your daily life and ability to perform substantial gainful activity (SGA).

To strengthen your application, gather all relevant medical records from healthcare professionals who have treated you for your disabling condition.

These records should include:

- Detailed descriptions of diagnoses;

- Treatment plans;

- Medications prescribed;

- Laboratory test results;

- Imaging studies such as X-rays or MRIs;

- Surgical reports if applicable; and

- Any other pertinent information related to your condition.

In addition to medical records from doctors and specialists, it can be beneficial to include statements from friends or family members who have witnessed the impact of your disability on your daily activities.

Their observations can provide valuable insights into how your condition affects you physically or mentally.

Remember that the more thorough and up-to-date your medical evidence is, the stronger your case will be when applying for social security disability benefits.

It is essential to keep track of all medical tests and appointments and maintain open communication with healthcare providers throughout the process.

Work History Information including W2 Forms or Self-Employed Tax Returns

Providing accurate work history information is another crucial aspect of your social security disability application.

The SSA needs to assess your past employment and earnings to determine if you meet the work requirements for disability benefits.

When submitting your application, include detailed work history information such as:

- The names and addresses of employers;

- Dates of employment;

- Job titles;

- A description of job duties; and

- The amount of money earned.

This information helps establish whether you have accumulated enough work credits to qualify for disability benefits.

If you were employed by someone else, W2 forms serve as official records of your earnings and can be obtained from your previous employers.

These forms provide a summary of your wages for each year and are essential in verifying your income history.

For individuals who were self-employed or worked in jobs that didn’t issue W2 forms, it is necessary to provide copies of tax returns filed during those years.

Step-by-Step Guide to Applying Online for Disability Benefits

Create an Account or Log In

Before beginning the online application for social security disability benefits, it is essential to establish an account on the Social Security Administration (SSA) website.

For those who already have an account, they can simply log in and move to the next step.

The process of establishing an account is straightforward.

Visit the SSA website and search for the option labeled “Create An Account”.

Upon finding it, click on the option and follow the instructions to input your personal details, including your name, address, date of birth, and Social Security number.

It is of utmost importance to ensure the accuracy of all the provided details, as any discrepancies could potentially result in a delay in the application process.

Complete the Online Application

After successfully logging into or creating your account, you are ready to proceed with the online disability application.

This application is structured to collect all the necessary information about your medical situation and employment history to establish your eligibility for disability benefits.

It is recommended that you take your time when completing each section of the application form.

You should provide comprehensive details about your medical condition, including any diagnoses or treatments prescribed by medical professionals.

Furthermore, it is important to be exhaustive when describing how your condition impacts your capacity to work and perform daily tasks.

It is also necessary to include any pertinent medications or therapies you are currently undergoing, as well as any assistive devices you use.

Accuracy is of utmost importance.

Providing incomplete or inaccurate information could potentially cause delays in the processing of your application.

Upload or Mail Required Documents

To support your disability claim effectively, certain documents must be submitted along with your online application.

These documents help substantiate your medical condition and its impact on your ability to work.

The SSA requires medical evidence such as doctor’s reports, test results, treatment records, and any other relevant documentation that proves the existence and severity of your condition.

It’s essential to gather these documents beforehand so that they can be uploaded directly through the online application.

In some cases, you may not have access to digital copies of your documents or prefer to mail them.

If that’s the case, you can print out the necessary forms and mail them to your local Social Security office.

Make sure to keep copies for your records and send them via certified mail to ensure they are received.

Review and Submit Your Application

After completing all the necessary sections of the online application and providing the required supporting documents, it is essential to carefully review the entire application before submission.

It is recommended to meticulously check each page for any errors or omissions.

This step is of utmost importance as any minor mistake or missing information could potentially delay the processing of the application.

It is critical to ensure that all the information provided is accurate and current.

Once the review is complete and the application is deemed satisfactory, proceed to submit the application.

Upon successful submission, an acknowledgement will be received from the Social Security Administration (SSA) confirming the receipt of the application.

This acknowledgement will contain a reference number that can be used for tracking the status of the application at a later stage.

After the submission of the online disability application, it is necessary to wait for the decision from the SSA.

It should be noted that the processing times can vary based on factors such as the volume of applications and the complexity of individual cases.

If assistance is required at any stage of the process or if there are any queries, it is advised to contact the local Social Security office for guidance.

The convenience of applying for social security disability benefits online can be utilized by creating an account or logging in if an account already exists.

Starting the application process at the earliest can expedite the receipt of the necessary support and assistance.

The Disability Determination Process: What to Expect

SSA Reviews Medical Evidence to Determine if You Meet Their Definition of Disability

The process of applying for social security disability benefits begins with the Social Security Administration (SSA) reviewing the applicant’s medical evidence.

This initial step is crucial as the SSA needs to ascertain whether the applicant’s condition falls under their definition of disability before they can proceed to award any benefits.

The SSA does not require applicants to have an extensive knowledge of medical terminologies.

The primary objective of this review is to determine if the applicant’s condition is severe enough to hinder their ability to work.

Therefore, it is essential for applicants to provide all relevant medical records and any other evidence that can substantiate their claim about the severity of their condition and how it affects their earning capacity.

Upon receiving all the necessary information, the SSA will conduct a thorough examination of the provided evidence.

This will include a detailed review of doctor’s reports, laboratory results, and statements from individuals who are familiar with the applicant’s condition.

Although this may seem intrusive, it is a necessary part of the process to ensure that only those who truly require assistance are awarded the benefits.

A State Agency Evaluates Your Case Based on Medical Records and Other Evidence

The Social Security Administration (SSA) has completed its initial review of your medical evidence and has determined potential eligibility for disability benefits.

The next phase of this process involves an evaluation by a state agency.

Each state has a designated agency responsible for assessing disability claims on behalf of the SSA.

The evaluators within these agencies conduct a comprehensive analysis of your case file to determine if you meet the criteria for disability benefits.

This analysis includes a thorough review of all medical records, such as X-rays and prescription histories.

Additionally, non-medical sources of information are also considered in the evaluation process.

This can include statements from acquaintances, family members, or employers that can provide insight into the impact of your condition on your capacity to work.

Upon completion of this comprehensive evaluation, the state agency will make a determination regarding your qualification for disability benefits.

Decision Made Regarding Eligibility for Benefits, Which Can Be Appealed if Denied

The state agency has concluded its evaluation of your eligibility for disability benefits.

If the outcome is favorable, and your claim has been approved, this will result in financial assistance for you.

However, it is important to note that there are further steps to be taken before the benefits can be fully accessed.

On the other hand, if your claim has been denied, it is crucial to understand that you have the right to contest this decision through an appeal.

The initial denial of a claim can be discouraging, but many individuals have successfully appealed this initial decision and subsequently obtained the benefits they are entitled to.

The process of appeal can be intricate, and it may be beneficial to seek the assistance of a legal professional or advocate who is experienced in social security disability cases.

It is vital to persist in this process if you believe that the benefits should be granted to you.

The Process May Take Several Months or Longer Due to High Caseloads

The process of disability determination may take an extended period, potentially several months or longer.

This duration can be attributed to the high volume of cases that the Social Security Administration (SSA) handles on an annual basis.

The SSA receives a substantial number of disability claims each year.

This high volume of cases, coupled with the administrative tasks associated with each claim, can result in a longer processing time.

It is important to note that the SSA operates with limited resources, which further contributes to the extended timeframes.

The sheer number of cases, in conjunction with the limited resources, can lead to inevitable delays in the processing of claims.

However, despite these delays, it is crucial to remain patient throughout the process.

The adage ‘good things come to those who wait’ is particularly relevant in this context.

Contacting Social Security for Assistance: Phone Application

Scheduling a Phone Interview

To initiate the process of applying for social security’s disability benefits, you will need to contact the Social Security Administration (SSA) through their toll-free number.

Simply give them a call and schedule an appointment for a phone interview.

This initial step is crucial as it allows you to provide important information about your disability and work history.

Preparing Necessary Documents

Before your scheduled phone interview, make sure you have all the necessary documents ready.

These may include medical records, employment history, and any other relevant paperwork that supports your disability claim.

Having these documents readily available will help streamline the application process and ensure accurate information is provided during the interview.

During the phone interview, it’s essential to provide accurate details about your disability and work history.

Be prepared to answer questions regarding your condition, its impact on your ability to work, and any treatments or therapies you have undergone.

By providing precise information, you can help the SSA representative better understand your situation and assess your eligibility for social security disability benefits.

The representative from the SSA will guide you through each step of the application process over the phone.

They are trained professionals who are well-versed in assisting individuals with their claims.

They will ask specific questions related to your disability and work history in order to gather all necessary information required for evaluating your case.

Remember that contacting Social Security for assistance via phone is just one way to apply for benefits.

If you prefer face-to-face interaction or have complex circumstances that require more detailed discussion, visiting a local Social Security office might be a better option for you.

However, utilizing the phone service offers convenience as it allows you to complete the application process from the comfort of your own home.

If possible, try scheduling your phone interview on a Monday or early in the week when call volumes tend to be lower.

This can minimize potential wait times and ensure faster access to the SSA representative.

If you have family members who can provide support or additional information about your disability, it may be helpful to have them present during the call.

Understanding the Different Types of Social Security Disability Benefits

Disability Insurance Benefits (DIB)

Disability Insurance Benefits (also known as DIB) are a crucial form of support for individuals who have become disabled and are unable to work.

This type of benefit provides income based on prior work earnings.

If you have paid into the Social Security system through payroll taxes, you may be eligible for DIB.

DIB is designed to provide financial assistance to individuals who have a long-term disability that prevents them from engaging in substantial gainful activity.

To qualify for DIB, you must meet certain criteria set by the Social Security Administration (SSA).

These criteria include:

- A person having a severe physical impairment OR mental impairment; and

- Their impairment is expected to last at least one (1) year or result in death.

If approved for DIB, you will receive monthly payments that can help cover your living expenses and medical costs.

The amount of benefits you receive depends on your average lifetime earnings before becoming disabled.

It’s important to note that there is a waiting period before benefits begin, typically five (5) months after the onset of your disability.

Disabled Widow(er)’s Benefits

Losing a spouse can be emotionally devastating, and it can also create financial hardships.

Fortunately, the Social Security Administration offers support through Disabled Widow(er)’s Benefits.

These benefits provide financial assistance to surviving spouses who become disabled within a certain timeframe after their spouse’s death.

To be eligible for Disabled Widow(er)’s Benefits, you must meet specific requirements set by the SSA:

- You must have been married to your spouse for at least nine (9) months before their death unless an exception applies;

- You must be between the ages of 50 and 60 years old; and

- You must have a disability that began before or within seven (7) years of your spouse’s passing.

These benefits can provide much-needed income to help alleviate some of the financial burdens faced by widowed individuals with disabilities.

It’s essential to understand that Disabled Widow(er)’s Benefits are separate from other types of survivor benefits offered by the SSA.

If you believe you qualify for these benefits, it is recommended to reach out to your local Social Security office or visit the official SSA website for further guidance.

Childhood Disability Benefits

Children with disabilities require additional support to thrive and reach their full potential.

Childhood Disability Benefits aim to assist children from eligible families who have severe impairments that limit their daily activities and are expected to last at least one year or result in death.

To be eligible for Childhood Disability Benefits, the child must be under the age of 18 (or 19 if still attending elementary or secondary school).

The child’s disability must meet the SSA’s definition of disability, which considers both medical and functional criteria.

These benefits can provide financial assistance to help cover medical expenses, therapy sessions, educational support, and other necessary resources for children with disabilities.

It’s important for parents or guardians of children with severe impairments to explore this option and understand the application process thoroughly.

Disabled Adult Child Benefits

Disabled Adult Child (DAC) Benefits offer crucial support for adults who became disabled during childhood.

This type of benefit recognizes that individuals who develop disabilities early in life may face unique challenges as they transition into adulthood.

To qualify for DAC benefits, an individual must:

- Be at least 18 years old;

- Have a disability that began before turning 22 years old;

- The disability should meet the SSA’s definition of disability; and

- The disability should significantly limit the individual’s ability to engage in substantial gainful activity.

DAC benefits can provide financial assistance to help cover living expenses, medical costs, and other necessities for disabled adults who have been unable to work due to their long-term impairment since childhood.

These benefits offer a lifeline of support as individuals navigate their adult lives while managing their disabilities.

Exploring Social Security Disability Insurance Benefits in Detail

Monthly Income Based on Past Earnings and Work History

If you find yourself unable to work due to a disability, Social Security Disability Insurance (SSDI) can provide you with a lifeline.

One of the key benefits of SSDI is that it offers monthly income based on your past earnings and work history.

This means that the amount you receive in benefits will be calculated using the average wages you earned before becoming disabled.

The Social Security Administration (SSA) takes into account your lifetime earnings when determining your SSDI benefits.

They use a complex formula to calculate your average indexed monthly earnings (AIME).

The AIME is then used to determine your primary insurance amount (PIA), which is the base amount of SSDI benefits you are eligible for.

It’s important to note that there is a maximum limit on how much you can receive in SSDI benefits each month.

This limit is adjusted annually and varies depending on factors such as inflation.

However, regardless of how much you were earning before becoming disabled, SSDI provides a crucial safety net by ensuring that you have some form of income to support yourself.

Medicare Coverage After Two Years

Another significant advantage of receiving SSDI benefits is that after being enrolled for two (2) years, you become eligible for Medicare coverage.

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, but it also covers certain people with disabilities.

Once you’ve been receiving SSDI benefits for two years, regardless of your age, Medicare becomes available to help cover your medical expenses.

This includes hospital stays, doctor visits, prescription medications, and other essential healthcare services.

Medicare consists of different parts:

- Part A covers hospital insurance.

- Part B covers medical insurance.

- Part C offers Medicare Advantage plans provided by private companies.

- Part D provides prescription drug coverage.

It’s important to understand each part and its specific coverage to make the most of your Medicare benefits.

By providing access to comprehensive healthcare coverage, SSDI not only offers financial support but also ensures that individuals with disabilities can receive the medical care they need without facing overwhelming expenses.

Auxiliary Benefits for Dependents

SSDI doesn’t just provide benefits for disabled individuals; it can also extend support to their dependents.

Under certain conditions, dependents may be eligible for auxiliary benefits through SSDI.

Dependents who may qualify for auxiliary benefits include:

- Spouses: If you are married and receiving SSDI, your spouse may be eligible for benefits. This is particularly true if your spouse is 62 years or older or caring for a child under the age of 16.

- Children: Disabled individuals’ children may also be entitled to auxiliary benefits. In general, unmarried children under the age of 18 (or up to 19 if still attending high school) can receive these benefits. Disabled adult children who became disabled before turning 22 may qualify.

It’s important to note that there are limits on how much total family benefit amount can be paid out based on the primary beneficiary’s earnings history.

However, these auxiliary benefits can provide crucial assistance to families dealing with disability-related financial challenges.

Work Incentives and Returning to Work

Returning to work after experiencing a disability can be a daunting task.

Fortunately, SSDI offers work incentives that allow beneficiaries to test their ability to return to work without losing their benefits right away.

One such incentive is the Trial Work Period (TWP).

During this period, which lasts nine (9) months, you can continue receiving full SSDI benefits regardless of how much you earn as long as your work activity is reported and considered substantial gainful activity (SGA).

The TWP provides an opportunity for individuals to gauge their ability to sustain employment while still having a safety net in case they find themselves unable to continue working due to their disability.

After completing the TWP, individuals enter the Extended Period of Eligibility (EPE).

During this phase, you can still receive benefits for any month your earnings fall below the SGA level.

If your earnings exceed the SGA level first full month, your benefits will stop.

However, if you experience a significant drop in earnings or are unable to continue working due to your disability within 36 months of entering the EPE, you may be eligible for Expedited Reinstatement of Benefits.

Key Facts about Social Security Disability Insurance Benefits

Benefit Amounts Based on Average Lifetime Earnings

The benefit amounts you receive are calculated based on your average lifetime earnings covered by social security taxes.

This means that the more you have contributed to social security throughout your working years, the higher your disability benefits will be.

The calculation takes into account your past earnings and applies a formula to determine the monthly benefit amount you are eligible for.

It’s important to note that there is a maximum limit to these benefits, so even if you had a high income during your career, there is a cap on how much you can receive in disability benefits.

Auxiliary Benefits for Eligible Family Members

In addition to the disabled worker’s benefit amount, eligible family members may also receive auxiliary benefits.

This is an important aspect of social security disability insurance as it provides support not only for the disabled individual but also for their dependents.

Family members who may qualify for auxiliary benefits include spouses, children, and sometimes even parents.

These additional benefits can provide financial assistance to help cover living expenses and medical costs associated with the disability.

It’s crucial to understand that eligibility requirements vary depending on the specific circumstances of each case.

Medicare Coverage After Two Years

After receiving social security disability insurance (SSDI) benefits for two years, individuals become eligible for Medicare health insurance coverage.

This is a significant advantage as it ensures access to essential healthcare services and can alleviate some of the financial burdens that come with managing a disability.

Medicare offers various coverage options, including hospital insurance (Part A), medical insurance (Part B), prescription drug coverage (Part D), and Medicare Advantage plans (Part C).

The specific coverage available depends on individual needs and preferences.

It’s advisable to explore all options thoroughly and consider consulting with a healthcare professional or counselor specializing in SSDI.

Vocational Rehabilitation Programs Enhancing Employment Prospects

Beneficiaries of social security disability insurance have the opportunity to participate in vocational rehabilitation programs.

These programs aim to enhance employment prospects and provide individuals with the necessary skills, training, and support to reenter the workforce if possible.

Vocational rehabilitation can include a range of services such as career counseling, job placement assistance, skills development, and adaptive technology training.

The goal is to help disabled individuals overcome barriers to employment and achieve financial independence.

By equipping them with the tools needed for success in the job market, vocational rehabilitation programs contribute significantly to improving their quality of life.

Concluding the Key Points on Social Security Disability

Moving forward, it is crucial to understand that Social Security Disability Insurance (SSDI) is not merely a financial safety net but a lifeline for those grappling with debilitating conditions.

The application process may seem daunting, but with careful planning and strategic guidance, it can be navigated successfully.

Remember, this is not a journey you have to undertake alone.

Numerous resources are available to help you understand the complexities of the SSDI system.

The key is to stay informed and patient throughout the process.

In the end, the goal is to ensure that you receive the benefits you rightfully deserve, thereby enhancing your quality of life despite any physical or mental limitations.

By understanding the differences between SSDI and SSI, eligibility criteria, application methods, required documents, and the determination process, individuals can better prepare for their social security disability journey.

Remember to reach out to our team if assistance is needed with your Social Security Disability Insurance claims.

Frequently Asked Questions

-

How long does it take to get approved for social security disability benefits?

The approval process varies depending on several factors such as individual circumstances and workload at the Social Security Administration (SSA).

It can take anywhere from a few months to over a year to receive a decision on your application.

-

Can I work while receiving social security disability benefits?

Yes, but there are limitations on limited income and how much you can earn while receiving benefits.

The SSA has specific guidelines regarding substantial gainful activity (SGA), which determines whether your earnings exceed the allowed limit.

-

What happens if my social security disability application is denied?

Experiencing a denial for Social Security Disability Insurance can be discouraging, but there are steps you can take thereafter.

If your Social Security Disability Insurance application is denied, you have the option to:

- Request a Reconsideration: This usually needs to take place within 60 days of when you receive the denial. A different person will review the application and make a new decision.

- Attend a Disability Hearing: If the reconsideration is denied, you can request a hearing where an Administrative Law Judge will consider your case.

- Apply for an Appeals Council Review or Federal Court Review: If the hearing also leads to a denial, these are the final steps in the appeals process.

Even if your application is denied, don’t lose hope.

Many initial applications are denied but can later be successful through the appeal process.

-

Will I lose my social security disability benefits if my condition improves?

If your medical condition significantly improves and you’re able to engage in substantial gainful activity (SGA), your eligibility for social security disability benefits may be reevaluated.

However, there are programs in place that provide continued support during periods of medical improvement or vocational training.

-

Can I apply for both SSDI and SSI at the same time?

Yes, it’s possible to apply for both SSDI and SSI benefits simultaneously.

However, the eligibility criteria and requirements differ for each program, so it’s essential to understand the distinctions and provide accurate information in your applications.

-

Can I receive social security disability benefits if I have a short-term disability?

Social security disability benefits are intended for individuals with long-term or permanent disabilities that prevent them from engaging in substantial gainful activity (SGA) for at least one year or result in death.

Short-term disabilities typically do not qualify for these benefits.

-

Are there any resources available to help me with my social security disability application?

Yes, there are numerous resources available to assist you with your social security disability application.

The Social Security Administration offers online guides, informational materials, and local offices where you can seek guidance throughout the process.

-

What happens if my social security disability claim is approved?

If your claim is approved, you will begin receiving monthly cash payments based on your average lifetime earnings before becoming disabled.

You may be eligible for other benefits such as Medicare coverage after a waiting period.

-

Can I reapply for social security disability benefits if my previous application was denied?

Yes, if your initial application is denied, you have the option to appeal the decision or reapply altogether.

-

What is the Social Security Disability 5 Year Rule?

The Social Security Disability 5-Year Rule allows individuals to bypass a required waiting period for receiving disability benefits if they had previously received disability benefits.

For more information regarding this, you can check out our page for this guide where we go into great depth regarding the Social Security Disability 5 Year Rule.

Experienced Attorney & Legal SaaS CEO

With over 25 years of legal experience, Jessie is an Illinois lawyer, a CPA, and a mother of three. She spent the first decade of her career working as an international tax attorney at Deloitte.

In 2009, Jessie co-founded her own law firm with her husband – which has scaled to over 30 employees since its conception.

In 2016, Jessie founded TruLaw, which allows her to collaborate with attorneys and legal experts across the United States on a daily basis. This hypervaluable network of experts is what enables her to share reliable legal information with her readers!

You can learn more about the Social Security Disability Insurance System by visiting any of our pages listed below:

Here, at TruLaw, we’re committed to helping victims get the justice they deserve.

Alongside our partner law firms, we have successfully collected over $3 Billion in verdicts and settlements on behalf of injured individuals.

Would you like our help?

At TruLaw, we fiercely combat corporations that endanger individuals’ well-being. If you’ve suffered injuries and believe these well-funded entities should be held accountable, we’re here for you.

With TruLaw, you gain access to successful and seasoned lawyers who maximize your chances of success. Our lawyers invest in you—they do not receive a dime until your lawsuit reaches a successful resolution!

Do you believe you’re entitled to compensation?

Use our Instant Case Evaluator to find out in as little as 60 seconds!

Camp Lejeune’s water contamination issue spanned several decades starting in the 1950s. Exposure to these chemicals has been linked to various serious health issues, including cancer, organ diseases, and death.

Research is increasingly suggesting a link between the use of Tylenol during pregnancy and the development of neurodevelopmental disorders, such as autism and ADHD, in infants.

Legal action is being taken against manufacturers of Aqueous Film-Forming Foam (AFFF), a chemical used in fighting fires. The plaintiffs allege that exposure to the foam caused health issues such as cancer, organ damage, and birth and fertility issues.

Here, at TruLaw, we’re committed to helping victims get the justice they deserve.

Alongside our partner law firms, we have successfully collected over $3 Billion in verdicts and settlements on behalf of injured individuals.

Would you like our help?