Boehringer Ingelheim Sanctions Revisited in New Pradaxa Lawsuit

- Last Updated: August 11th, 2023

Attorney Jessica Paluch-Hoerman, founder of TruLaw, has over 28 years of experience as a personal injury and mass tort attorney, and previously worked as an international tax attorney at Deloitte. Jessie collaborates with attorneys nationwide — enabling her to share reliable, up-to-date legal information with our readers.

Legally Reviewed

This article has been written and reviewed for legal accuracy and clarity by the team of writers and legal experts at TruLaw and is as accurate as possible. This content should not be taken as legal advice from an attorney. If you would like to learn more about our owner and experienced injury lawyer, Jessie Paluch, you can do so here.

Fact-Checked

TruLaw does everything possible to make sure the information in this article is up to date and accurate. If you need specific legal advice about your case, contact us by using the chat on the bottom of this page. This article should not be taken as advice from an attorney.

Boehringer Ingelheim Sanctions Revisited in New Pradaxa Lawsuit

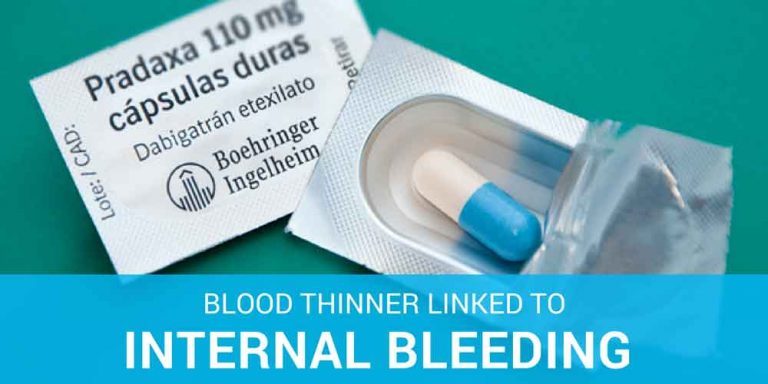

A family suing Boehringer Ingelheim for wrongful death as a result of uncontrollable bleeding that was attributed to Pradaxa would like the Massachusetts Federal court to take into account the record of Boeheringer’s misconduct in earlier Pradaxa cases.

Two years ago, Boehringer Ingelheim agreed to pay 650 Million to compensate nearly 4,000 individuals who alleged they suffered uncontrollable bleedings as a result of Pradaxa usage.

Like the Liu family, who is awaiting a June trial, previous plaintiffs alleged that Boehringer did not warn the public or doctors that there was no way to reverse the anti-coagulating effects in patients who experience bleeding events.

Unlike the standard blood-thinning medicine warfarin, Pradaxa did not have an antidote available until October 2015.

During the earlier Pradaxa MDL litigation ending in settlement, U.S. District Judge David Herndon imposed sanctions on Boehringer Ingelheim on two separate occasions warning the defendants that he would not tolerate the disregard of discovery rules or court orders.

Sanctions and fines prior to the $650 million settlement were nearly $1 million.

The Liu family is now requesting that a federal judge in Massachussets should take into account the record of Boehringer’s misconduct in the current lawsuit which includes a

shocking litany of serial disregard for discovery obligations, noncompliance with court orders, failure to produce as ordered , cirtical documents in advance of the depositions of company witnesses and most shockingly, the failure of Boeheringer to identify a sernior scientist employee who was intimately involved in assessing the safety and efficacy of Pradaxa as a custodian of relevant information, followed by the destruction of that scientist’s custodial file and data that had existed on that employee’s laptop, desktop computer and Blackberry.

Pradaxa is a prescription blood-thinning medicine used to reduce the risk of stroke and blood clots in people with atrial fibrillation.

Pradaxa hit the market in 2010 after being the subject of much hype via “informational” commercials about atrial fibrillation and the need for “therapeutic simplification.”

Pradaxa stepped right into that role gaining blockbuster sales of over $1 billion in annual sales shortly after hitting the market.

Table of Contents

Managing Attorney & Owner

With over 25 years of legal experience, Jessica Paluch-Hoerman is an Illinois lawyer, a CPA, and a mother of three. She spent the first decade of her career working as an international tax attorney at Deloitte.

In 2009, Jessie co-founded her own law firm with her husband – which has scaled to over 30 employees since its conception.

In 2016, Jessie founded TruLaw, which allows her to collaborate with attorneys and legal experts across the United States on a daily basis. This hypervaluable network of experts is what enables her to share the most reliable, accurate, and up-to-date legal information with our readers!

Here, at TruLaw, we’re committed to helping victims get the justice they deserve.

Alongside our partner law firms, we have successfully collected over $3 Billion in verdicts and settlements on behalf of injured individuals.

Would you like our help?

At TruLaw, we fiercely combat corporations that endanger individuals’ well-being. If you’ve suffered injuries and believe these well-funded entities should be held accountable, we’re here for you.

With TruLaw, you gain access to successful and seasoned lawyers who maximize your chances of success. Our lawyers invest in you—they do not receive a dime until your lawsuit reaches a successful resolution!

AFFF Lawsuit claims are being filed against manufacturers of aqueous film-forming foam (AFFF), commonly used in firefighting.

Claims allege that companies such as 3M, DuPont, and Tyco Fire Products failed to adequately warn users about the potential dangers of AFFF exposure — including increased risks of various cancers and diseases.

Depo Provera Lawsuit claims are being filed by individuals who allege they developed meningioma (a type of brain tumor) after receiving Depo-Provera birth control injections.

A 2024 study found that women using Depo-Provera for at least 1 year are five times more likely to develop meningioma brain tumors compared to those not using the drug.

Suboxone Tooth Decay Lawsuit claims are being filed against Indivior, the manufacturer of Suboxone, a medication used to treat opioid addiction.

Claims allege that Indivior failed to adequately warn users about the potential dangers of severe tooth decay and dental injuries associated with Suboxone’s sublingual film version.

Social Media Harm Lawsuits are being filed against social media companies for allegedly causing mental health issues in children and teens.

Claims allege that companies like Meta, Google, ByteDance, and Snap designed addictive platforms that led to anxiety, depression, and other mental health issues without adequately warning users or parents.

Transvaginal Mesh Lawsuits are being filed against manufacturers of transvaginal mesh products used to treat pelvic organ prolapse (POP) and stress urinary incontinence (SUI).

Claims allege that companies like Ethicon, C.R. Bard, and Boston Scientific failed to adequately warn about potential dangers — including erosion, pain, and infection.

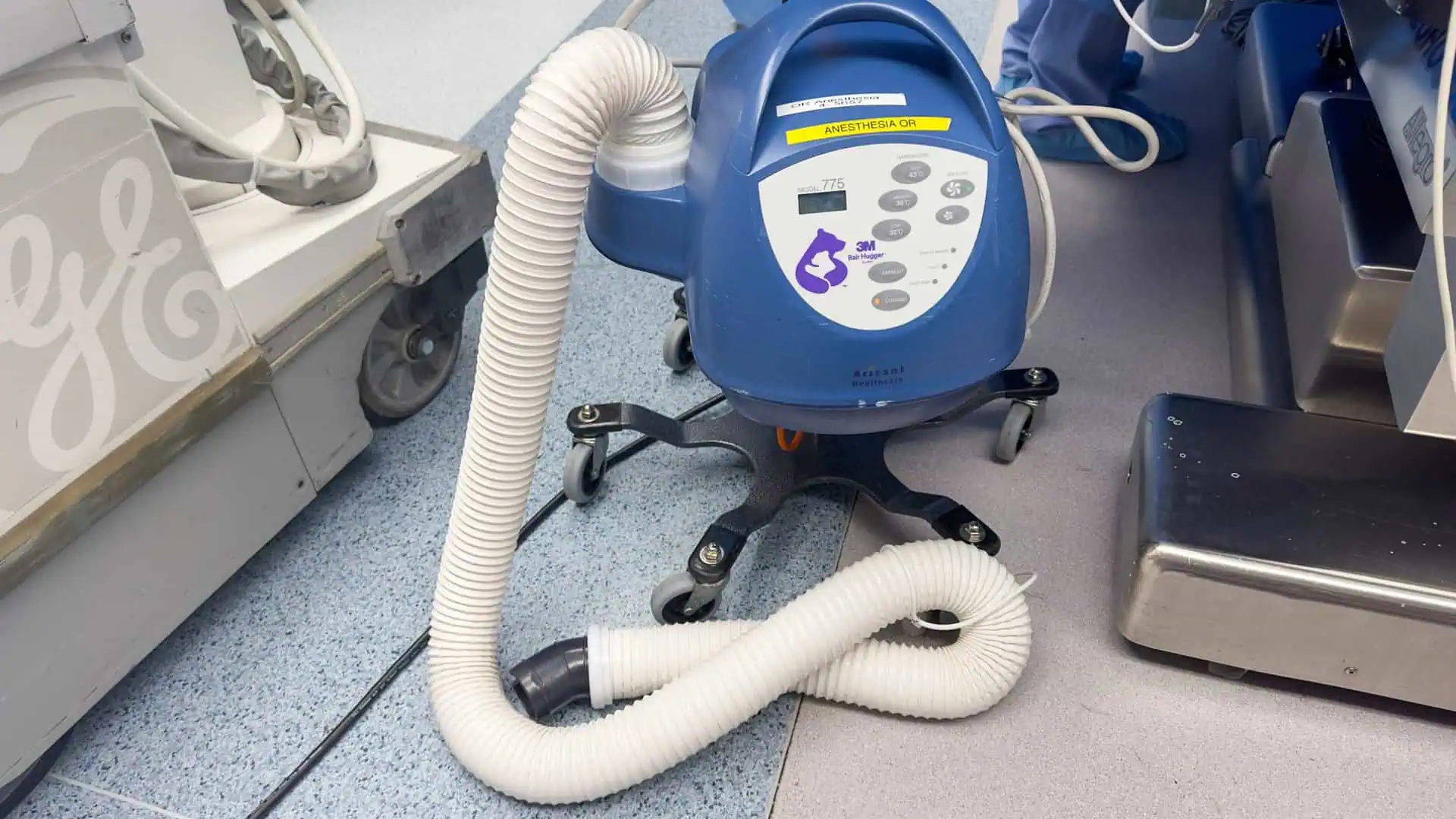

Bair Hugger Warming Blanket Lawsuits involve claims against 3M — alleging their surgical warming blankets caused severe infections and complications (particularly in hip and knee replacement surgeries).

Plaintiffs claim 3M failed to warn about potential risks — despite knowing about increased risk of deep joint infections since 2011.

Baby Formula NEC Lawsuit claims are being filed against manufacturers of cow’s milk-based baby formula products.

Claims allege that companies like Abbott Laboratories (Similac) and Mead Johnson & Company (Enfamil) failed to warn about the increased risk of necrotizing enterocolitis (NEC) in premature infants.

Here, at TruLaw, we’re committed to helping victims get the justice they deserve.

Alongside our partner law firms, we have successfully collected over $3 Billion in verdicts and settlements on behalf of injured individuals.

Would you like our help?