The Social Security Disability Insurance (SSDI) evaluation process is designed to assess whether an applicant meets the legal and medical criteria for receiving benefits.

This process involves a detailed review of the applicant’s work activity, medical condition, and ability to perform past or alternative work.

The 5-Step Evaluation Process

The SSA uses a 5-step sequential evaluation process to determine whether an individual qualifies for SSDI.

Each step builds on the previous one, allowing the SSA to systematically assess an applicant’s ability to work and the severity of their medical condition.

Failure to meet the criteria at any step can result in a denial of benefits.

1.) Current Work Activity

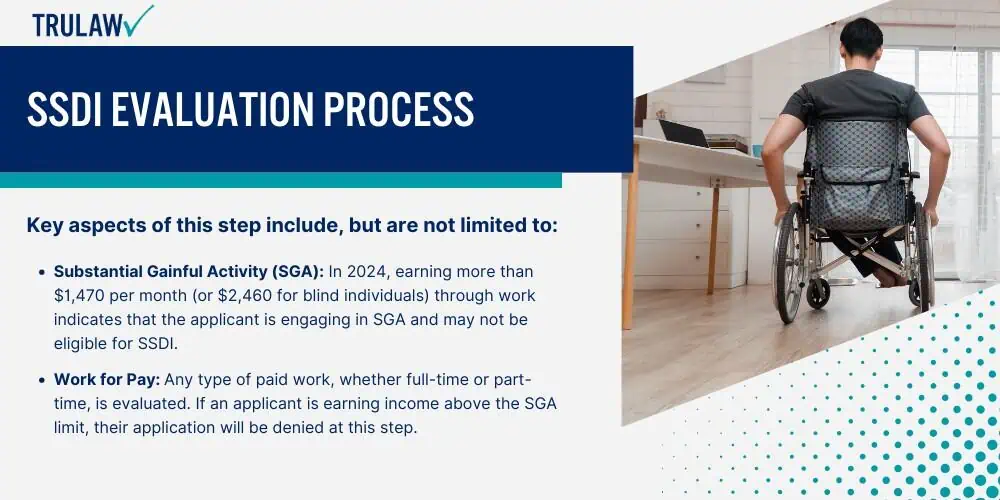

The first step of the SSDI evaluation process focuses on the applicant’s current work activity.

The SSA examines whether the individual is engaged in substantial gainful activity (SGA), which refers to the ability to perform significant physical or mental work for pay.

Key aspects of this step include, but are not limited to:

- Substantial Gainful Activity (SGA): In 2024, earning more than $1,470 per month (or $2,460 for blind individuals) through work indicates that the applicant is engaging in SGA and may not be eligible for SSDI.

- Work for Pay: Any type of paid work, whether full-time or part-time, is evaluated. If an applicant is earning income above the SGA limit, their application will be denied at this step.

This step ensures that SSDI is reserved for individuals who cannot engage in any meaningful work due to their disability.

2.) Severity of Medical Condition

If the applicant is not engaged in substantial gainful activity, the SSA moves to step two, which evaluates the severity of the applicant’s medical condition.

The condition must significantly limit the individual’s ability to perform basic work activities.

The criteria for evaluating severity include, but are not limited to:

- Duration: The disability must be expected to last at least 12 months or result in death.

- Work Limitations: The condition must severely limit the ability to perform tasks such as lifting, walking, standing, or understanding and following instructions.

At this stage, the SSA assesses whether the medical condition is serious enough to interfere with the applicant’s ability to perform basic work tasks.

3.) List of Impairments

The third step involves comparing the applicant’s medical condition with the SSA’s Listing of Impairments, commonly referred to as the “Blue Book.”

This list includes medical conditions that are considered severe enough to automatically qualify for SSDI benefits.

Key elements of this step include, but are not limited to:

- Meeting the Listings: If an applicant’s condition matches or exceeds the severity of a condition listed in the Blue Book, they are automatically considered disabled.

- Equaling the Listings: Even if an applicant’s condition is not exactly listed, they may still qualify if their condition is medically equivalent to a listed impairment.

If the applicant’s condition is not on the list, the evaluation process moves to the next step.

4.) Ability to Perform Past Work

In step four, the SSA evaluates whether the applicant is capable of performing any of the work they did in the past.

This includes assessing their ability to return to their previous employment, based on their medical condition.

Important considerations for this step include, but are not limited to:

- Previous Job Tasks: The SSA examines the physical and mental requirements of past jobs and whether the applicant can still perform those tasks.

- Medical Limitations: The applicant’s medical condition is compared to the functional requirements of their previous work. If they cannot perform the same job due to their disability, the evaluation proceeds to the next step.

This step ensures that applicants cannot perform their previous job before considering other employment options.

5.) Ability to Perform Other Types of Work

The final step assesses whether the applicant can perform any other type of work available in the national economy.

The SSA considers the applicant’s age, education, work experience, and medical condition to determine whether they can transition to a different type of work.

Factors that influence this step include, but are not limited to:

- Age: Younger individuals may be expected to adapt more easily to new types of work, while older individuals may face more difficulty in transitioning.

- Education and Skills: The SSA evaluates whether the applicant’s education or skill set can be used in less demanding work environments.

- Medical Condition: The severity of the applicant’s medical condition is weighed against the physical and mental requirements of potential new jobs.

If the applicant is unable to perform any other type of work due to their condition, they will be deemed disabled and eligible for SSDI benefits.