Social Security Disability Insurance (SSDI) is a federal program that provides financial support to individuals who are unable to work due to a disabling medical condition.

SSDI is part of the greater U.S. social safety net, which is funded by payroll taxes under the Federal Insurance Contributions Act (FICA).

To be eligible for SSDI, an individual must meet specific criteria, which include a sufficient work history and payment of Social Security taxes on their earnings.

The program is designed to replace a portion of the income lost due to a disability that prevents substantial gainful activity.

Common SSDI Acronyms and Abbreviations

These terms represent key components of the SSDI program and are frequently used in official communications and eligibility determinations.

Familiarity with these acronyms can help applicants better understand their rights, responsibilities, and the steps involved in securing benefits.

Recognizing these abbreviations also facilitates more precise communication with legal representatives and Social Security Administration (SSA) officials.

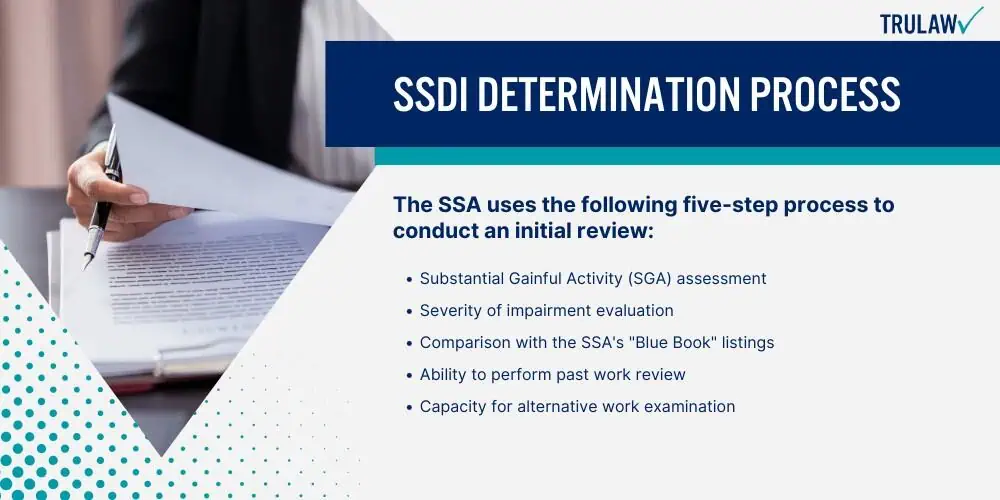

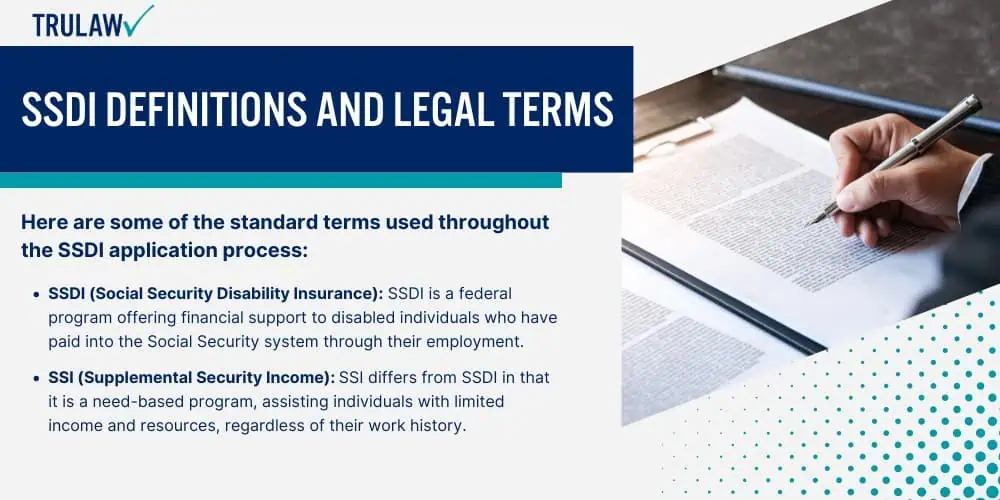

Here are some of the standard terms used throughout the SSDI application process:

- SSDI (Social Security Disability Insurance): SSDI is a federal program offering financial support to disabled individuals who have paid into the Social Security system through their employment.

- SSI (Supplemental Security Income): SSI differs from SSDI in that it is a need-based program, assisting individuals with limited income and resources, regardless of their work history.

- Substantial Gainful Activity (SGA): Refers to the level of work activity and earnings considered by the SSA to be gainful employment. Earnings above a specific threshold may disqualify an individual from receiving SSDI benefits.

- Medically Determinable Physical or Mental Impairment: Physical or mental impairments that can be diagnosed by clinical and laboratory techniques. A mental impairment must be documented by acceptable medical evidence.

- Work Credits: The work credits required to qualify for SSDI are earned based on the individual’s earnings, with a maximum of four credits per year.

- AC (Appeals Council): The Appeals Council reviews decisions made by Administrative Law Judges (ALJs), offering claimants the opportunity to seek further review if they disagree with the initial ruling.

It is important to have a clear understanding of these terms and definitions to navigate the SSDI application process effectively.

Each term has specific legal implications that may impact eligibility, benefit calculations, and the overall outcome of a claim.

Knowing the difference between SSDI and SSI, for instance, helps applicants determine the appropriate program for their needs.

Additionally, understanding the appeals process and the role of the Appeals Council ensures that applicants are fully informed of their rights to contest unfavorable decisions.